Guideline Integration Overview

This overview outlines the Guideline/Eddy integration process.

About Guideline

Guideline offers low-cost, highly automated retirement plans that make it easy for companies to offer a valuable benefit—and easy for people to invest in their financial future.

Getting started

To enable the integration, you will need to have admin-level access to Eddy. This integration is only available to companies using Eddy Payroll.

Connect to Guideline

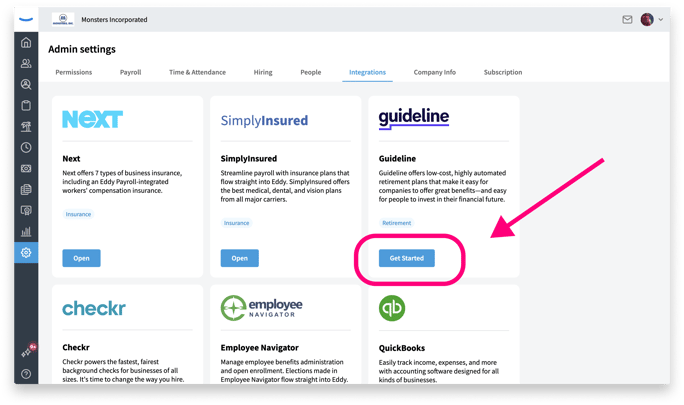

To connect the Guideline integration, navigate in Eddy to the Admin settings page and click the Integrations tab. On the Guideline card, click the Get started button.

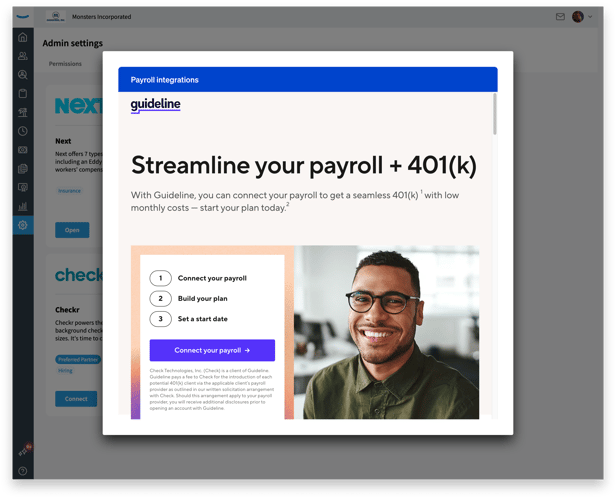

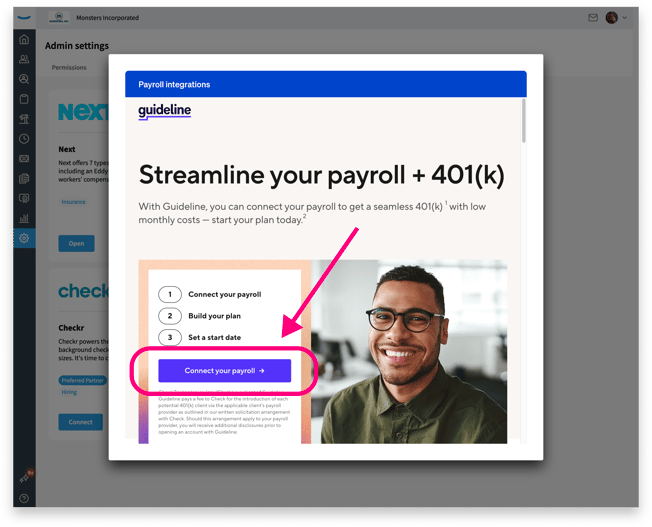

When you click the Get started link you'll see a page built by Guideline that gives information about their products.

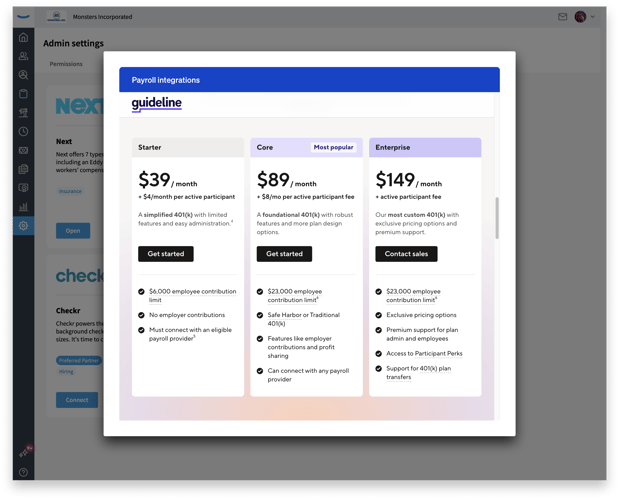

You can scroll down this page to learn more and view pricing information.

When you are ready to continue, click the Connect your payroll button.

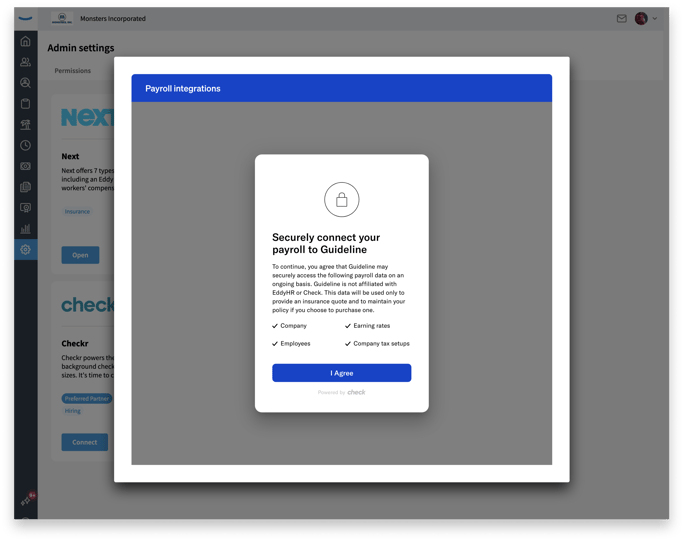

The next screen asks you to agree to share payroll data with Guideline so that Guideline can create a price quote as well as to maintain your account if you choose to move forward.

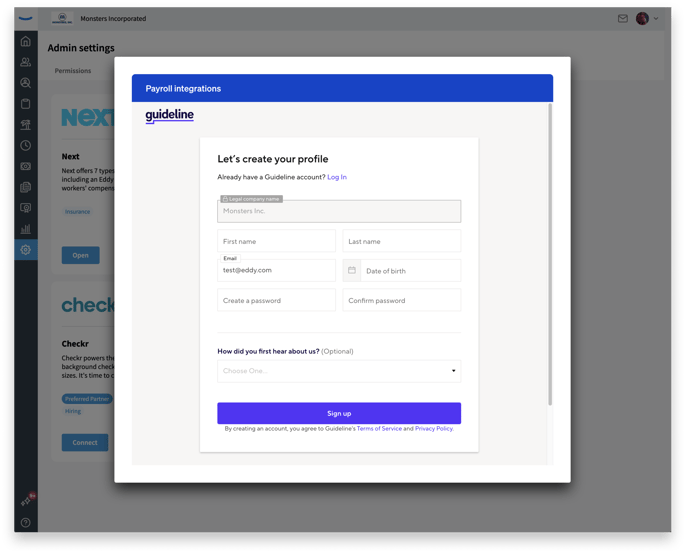

When you click the I agree button, you'll see a series of pages that let you create an account and share additional information with Guideline.

For existing Guideline customers

Existing Guideline customers can connect to Eddy by following this Guideline Help Center article The article outlines the process to change payroll providers within Guideline’s system.

Contact Guideline Sales Team

If you would like to speak with a Retirement Specialist from Guideline you can reach the Guideline sales team in one of two ways:

- By phone: (888) 228-3491

- By email: hello@guideline.com

Guideline Benefits

Here's what we like about Guideline:

- Guideline plans are easy to set up. Customers can set up a 401(k) plan in 20 minutes. From there, it’s pretty hands off. Guideline takes care of plan administration, recordkeeping, government filing, and more.

- Guideline offers affordable plans for businesses of all sizes. All of Guideline’s plans have low monthly costs and no transaction fees. For employees, Guideline asset fees start at 0.15%, which is 7x lower than the industry average.

- Intelligent investing can help support your employees. Guideline can help participants select a diversified investment portfolio—with low-cost funds across asset classes—that rebalances automatically to stay on track.

- Our integration with Guideline makes 401(k) management seamless. Guideline will securely sync with your payroll data so any updates or changes will be reflected in both places automatically, saving you time and hassle.

Ongoing Support for Guideline Customers

Guideline customers can contact Guideline with support needs or general questions. This info is available for existing Guideline customers on their Guideline dashboard. You can reach Guideline from 9 a.m.-7 p.m. ET, Monday through Friday.

- https://guidelineinc.my.site.com/helpcenter/s/contactsupport

- Employees: (888) 344-5188 or support@guideline.com

- Employers: (888) 228-3491 or clients@guideline.com

- IRA: (888) 810-3801 or ira@guideline.com

Guideline & ERISA reporting

Guideline automates the compliance testing process.The Guideline system helps each plan remain compliant by using data the plan provides us to generate projected non-discrimination testing results. These test results are made available to sponsors via the Compliance section of their Guideline dashboard, where they can actively monitor the plan’s current compliance status at any given time throughout the year.

Please note these reports will only provide projections. The actual test results will be known after the end of the plan year when all contributions are made and full plan year compensation and final census data is known. For this reason, it is critical for sponsors to provide Guideline with employee compensation so these tests can be calculated timely.

Throughout the year, sponsors should review their Compliance dashboard to monitor their risk of falling outside IRS compliance limits. If they have any questions, Guideline specialists can discuss their options with them.

Additionally, Guideline includes the preparation and electronic filing of the Form 5500 at no added cost for all assets that reside within the Guideline plan. For example, if a plan started with Guideline this year, Guideline will not prepare or file the previous year’s Form 5500.

If a plan transferred to Guideline earlier this year, and needs to file the Form 5500 for the previous plan year, the plan should work with their prior administrator to file their form. Likewise, if a plan transfers from Guideline to another service provider before the end of the filing year, the plan should work with their new provider to file their form.