How do I add and edit bank account information?

Adding your bank account information to Eddy will help streamline the company's payroll process and ensure a smooth and efficient payment system for your paycheck. It enables us to process your salary through direct deposit, ensuring efficient and timely payments. Direct deposit eliminates the need for physical checks, offering convenience and security.

By adding your bank account details, we can ensure accurate payroll recording and minimize the risk of errors. Rest assured that your information is stored securely, and only authorized personnel have access to it.

How to add bank account info

Banking info can be added to Eddy as part of your employee onboarding experience, and also from your employee profile page.

During onboarding

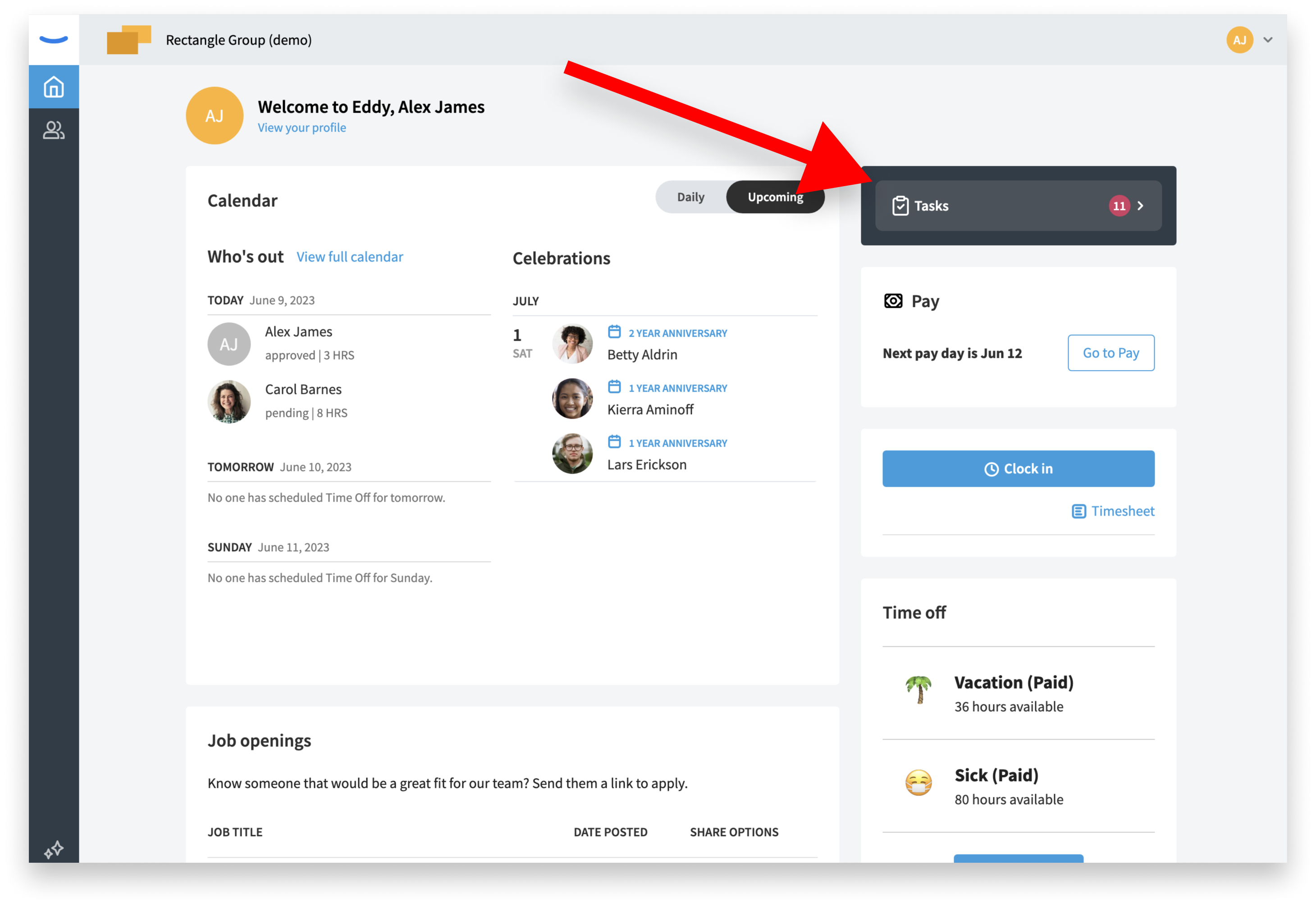

Bank account info can be added during your initial employee onboarding. You'll see a task list on your home page and will have a task to add your bank account info

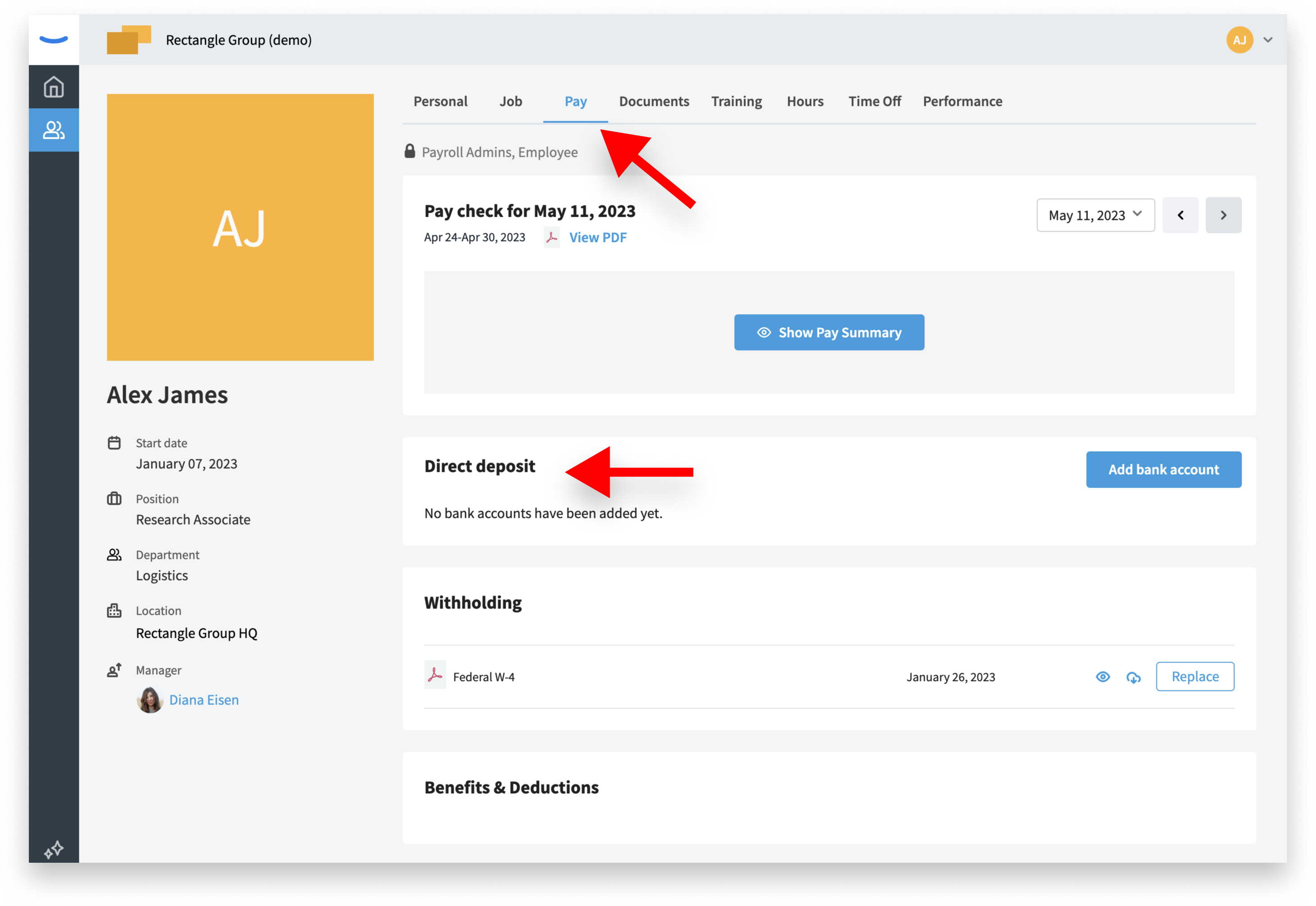

On your employee profile

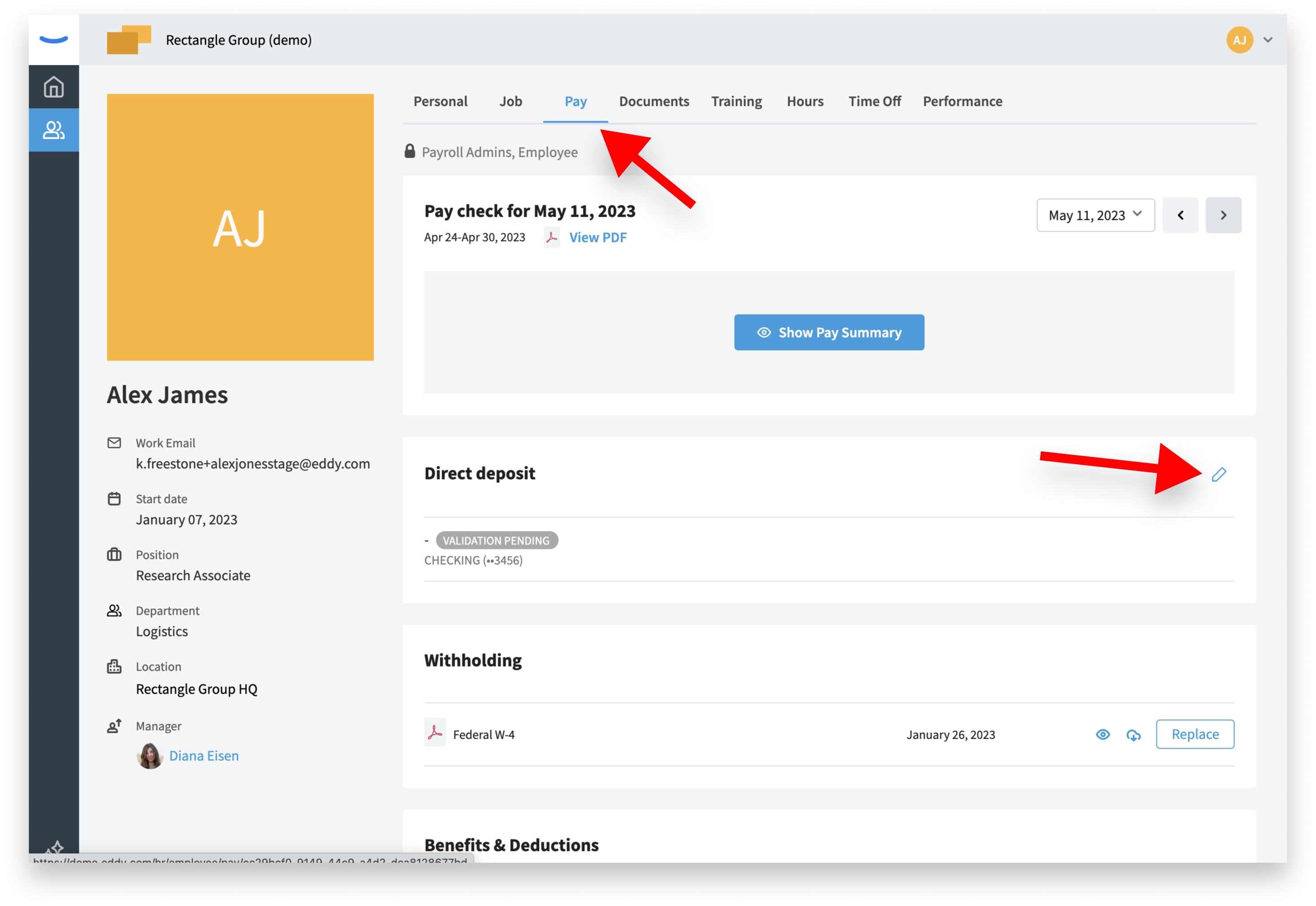

Bank account info can also be added from your employee profile on the pay tab. On this page you'll find a Direct deposit card that shows an Add bank account button.

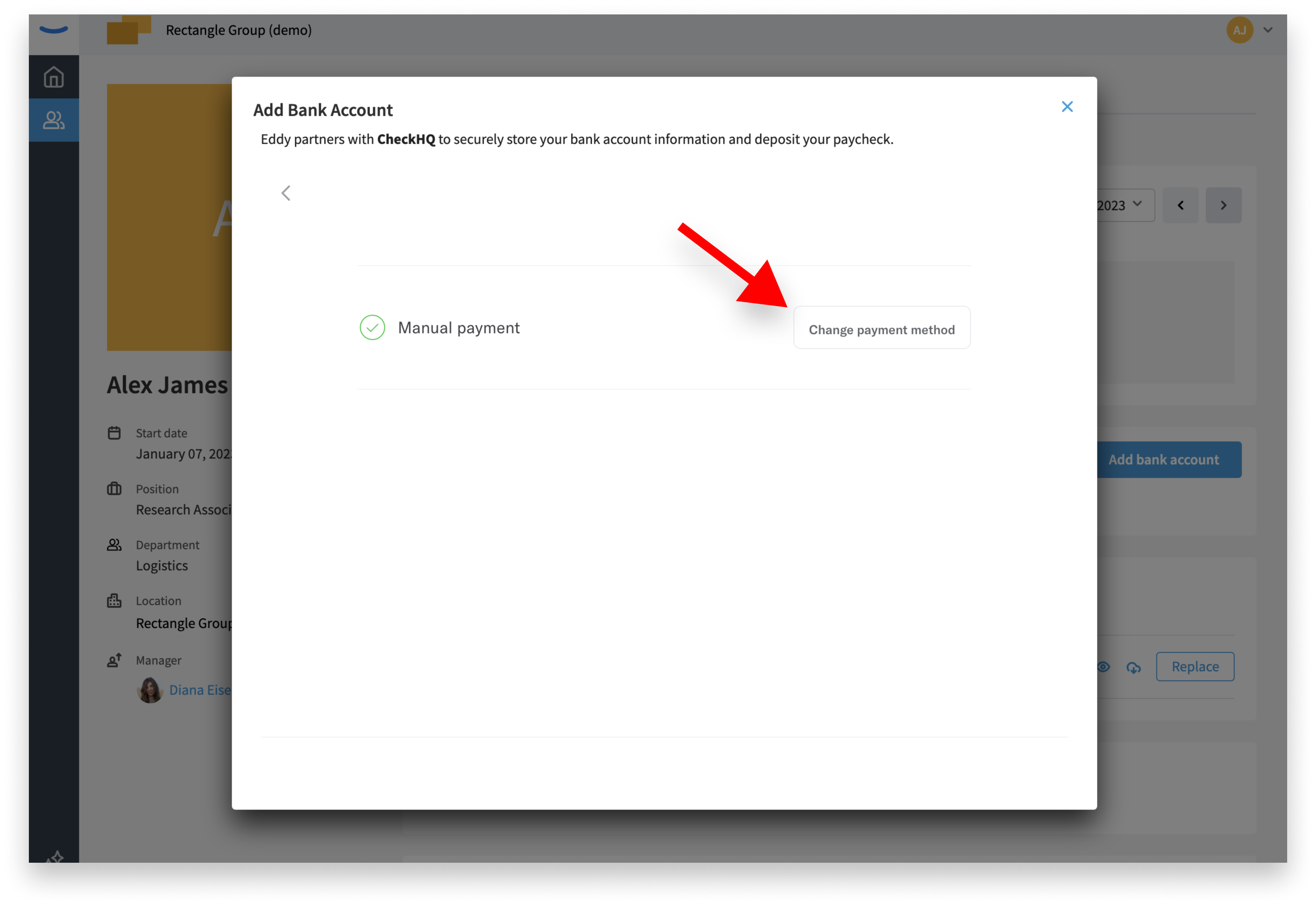

When adding a first bank account, you start by changing your payment method from paper checks (a "manual payment").

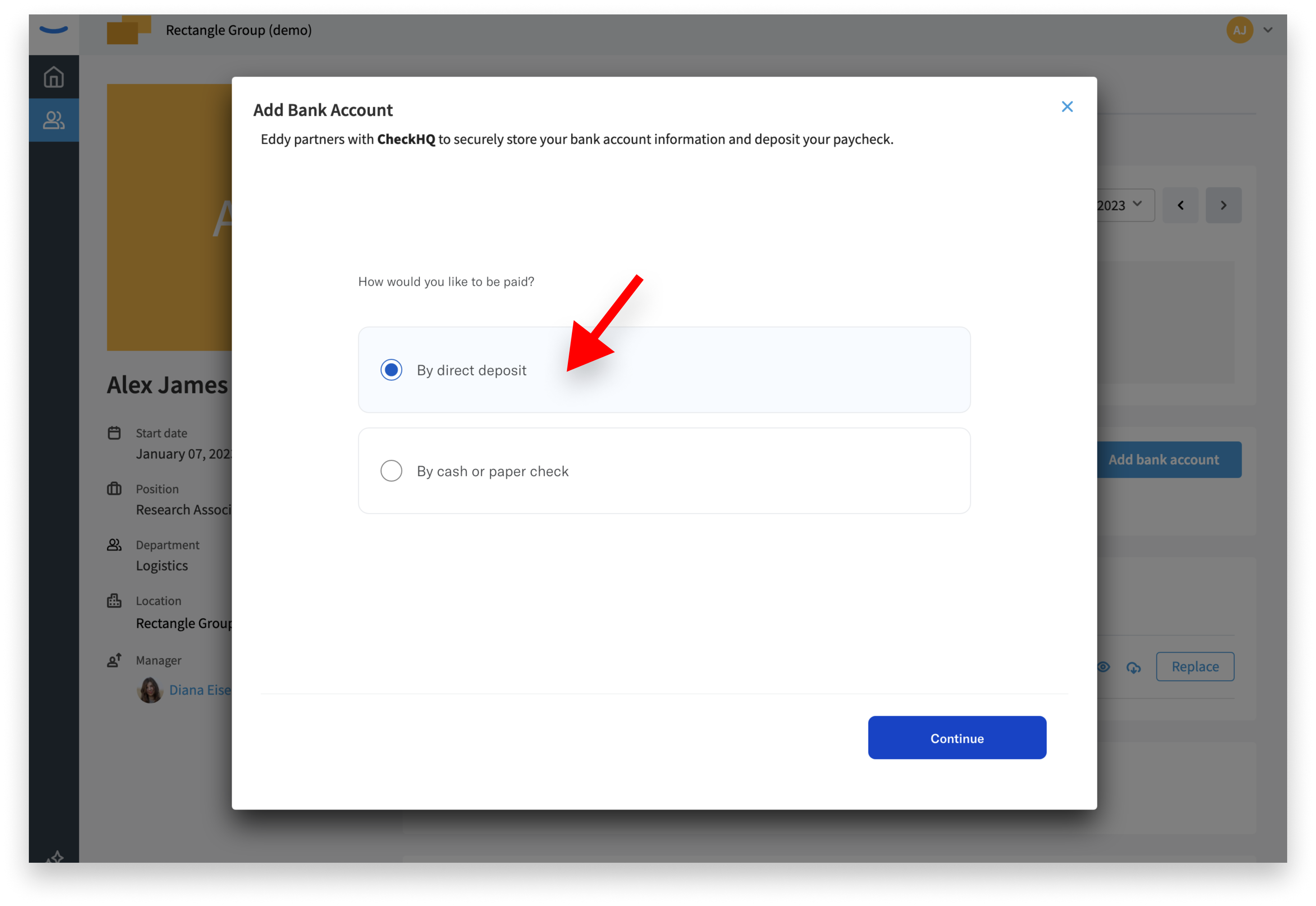

On the next screen you indicate your preference to be paid by direct deposit.

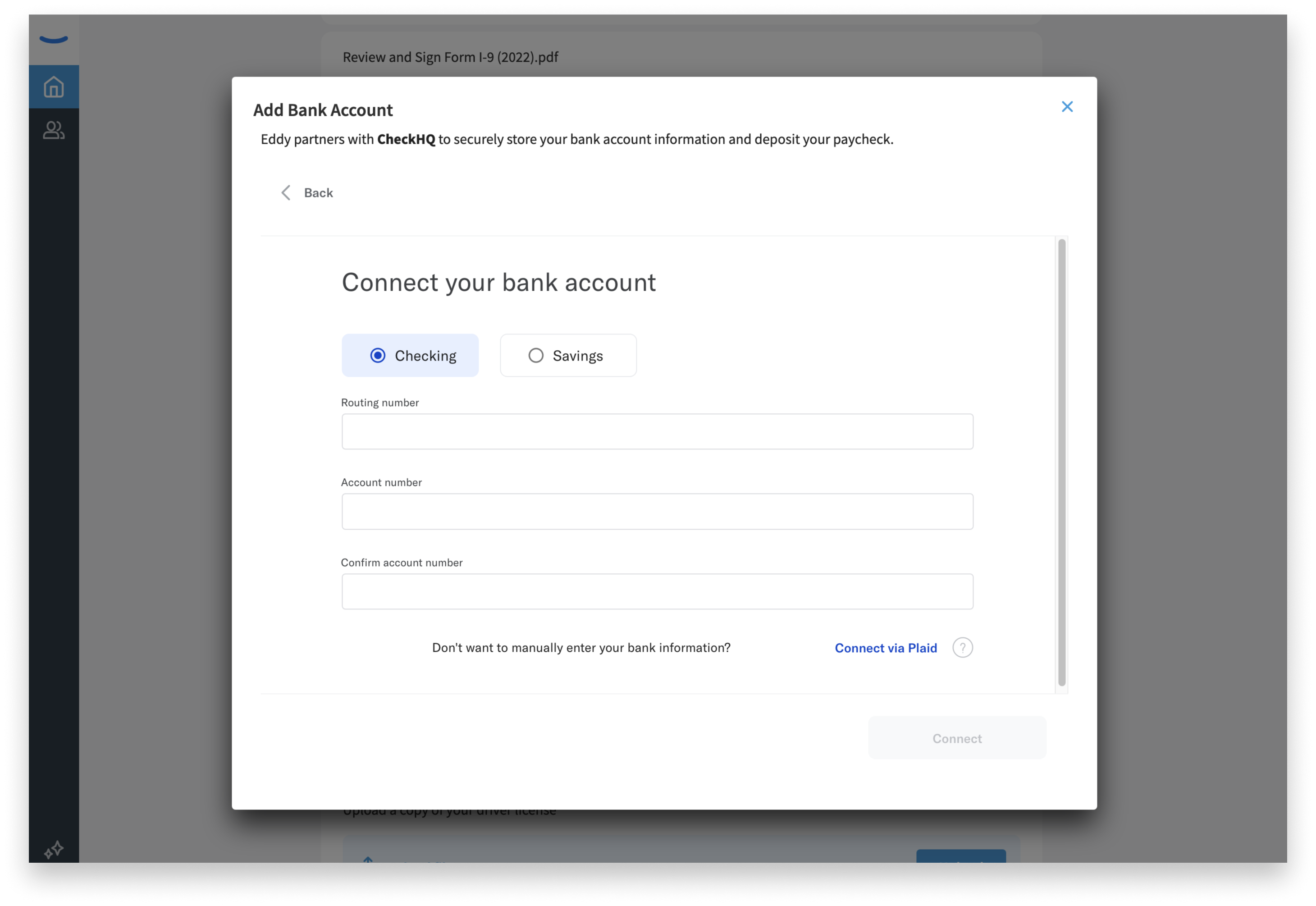

The next step is to add your bank routing number and account number. You can find your bank routing number in a few different ways:

-

Check: The routing number is typically printed at the bottom left corner of your personal checks. It is the 9-digit number that comes before your account number.

-

Online Banking: If you have online banking access, you can log in to your account and navigate to the account details section. The routing number should be listed there along with your account information.

-

Bank Statement: Your bank statement, whether received electronically or in paper form, usually includes your routing number. Look for the section that displays your account details.

-

Bank's Website: Visit your bank's official website and search for information on finding your routing number. Many banks provide specific instructions or have a dedicated page to help customers locate their routing numbers.

-

Contact the Bank: If you are unable to find your routing number through the above methods, you can contact your bank's customer service directly. They will be able to provide you with the correct routing number associated with your account.

Remember, the routing number is specific to each bank and helps identify the financial institution through which transactions are processed. It's essential to double-check the accuracy of the routing number before providing it to ensure smooth and error-free transactions.

Connect via Plaid

Plaid is a helpful service that lets you connect your bank account to different apps or websites securely. To connect your bank account using Plaid, click the connect via Plaid link and then search for your bank, choose how to log in, enter your banking details, give permission to Plaid, and (depending on your bank) you may need to answer some security questions.

Once connected, you can select which bank account(s) you want to link, so the app or website can access the information it needs for things like managing your money or processing payments. Plaid makes it easy and safe to connect your bank account.

How to update bank account info

You can update your bank account info at any time. This is done from your employee profile page. On the Pay tab look for the Direct deposit can and click the edit icon that looks like a pencil on the left side of the card.

Replace an account

You must have at least one bank account enabled, so to replace an account the first step is to add the new account, enable the new account, and then you can disable and remove the original bank account.

Create a pay split with multiple accounts

You can add up to seven bank accounts and decide how your paycheck will be distributed across these multiple accounts. To do this, first add each desired bank account. Next enter the desired amount you want to allocate to each account. You can re-order the accounts. Payments are allocated to the accounts in the order they are listed, so if your paycheck doesn't have enough funds for all your accounts, the ones at the top of the list are given priority.

Review the information entered and save the pay split. Once saved, Eddy will distribute the designated portions of your paycheck to the specified accounts accordingly. It's important to double-check the accuracy of the account details before confirming to ensure proper distribution of funds.

Bank Account Validation

Eddy will try to connect to your bank account prior to payday to make sure the bank account info you have added is complete and accurate. If we are not able to successfully connect to your bank we will send you a notification.

Connection errors are typically caused when you have entered incorrect routing or account numbers when you tried to add your bank account to Eddy. Make sure you have the correct account information and try re-adding your bank account. And be sure to do it soon—you can’t be paid by direct deposit until you add a valid bank account.