How to complete your W4 form in Eddy

What is Form W-4?

Form W-4 is a form designed by the Internal Revenue Service (IRS) to help your employer withhold the correct federal income tax from your pay. Each employee must complete Form W-4.

When to fill out the form?

This is typically done when you start a new job, but can also be updated at any time in Eddy. Any time you have a major life event you should consider updating your W-4. A marriage, divorce, a new baby, or a child turning 17 will have an effect on your taxes and should be taken into consideration in filling out your W-4.

Why does it matter?

The Form W-4 can impact how much money is taken out of your paycheck. If you withhold too much, you can end up with a large refund. If you withhold too little, you can create a balance due and potentially an underpayment penalty.

While you can allow your employer to simply withhold at default levels, the easiest path may not be the best. To get the right balance between paycheck and your refund, you might need to take time to understand how to fill out the form's details.

Steps to consider

The Form W-4 has 3 steps where you need to make withholding decisions. These steps are labeled Step 2, Step 3, and Step 4.

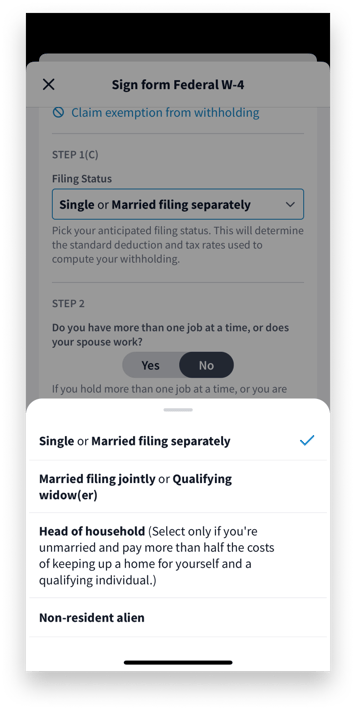

In step 1(c) you'll indicate your filing status:

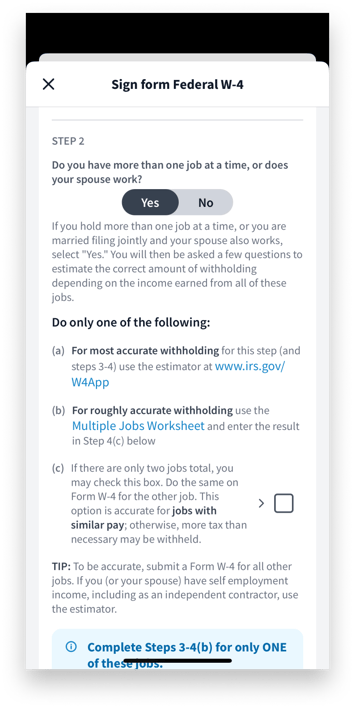

Step 2: Account for all jobs you and your spouse have

If you are married, you should fill out your W-4 with your combined income in mind, including self-employment. Otherwise, you may set up your withholding at too low a rate.

To fill out this part correctly, you have three choices. You can:

- Use an online estimator to determine a specific amount to have your employer withhold each pay period. This method works the best if you have income from self-employment, because it helps allow for self-employment taxes in addition to income taxes.

- Use a worksheet attached to the W-4 form if there are multiple jobs in your household (either you have multiple jobs or you and your spouse each work). Both the online estimator method and worksheet method work well if you’d prefer not to give your employer information about other income you might have. Or,

- Check a box and have your employer withhold at a default rate. Checking the box works best if all the jobs have a similar amount of pay.

Checking the box for the default method may seem like the easiest choice. But this will sometimes result in a refund check and much smaller paychecks throughout the year. If you are in a good enough financial situation, this may not seem like a big deal. But for some taxpayers, they’d like to maximize their paycheck amount while making sure their tax liability is covered for the year.

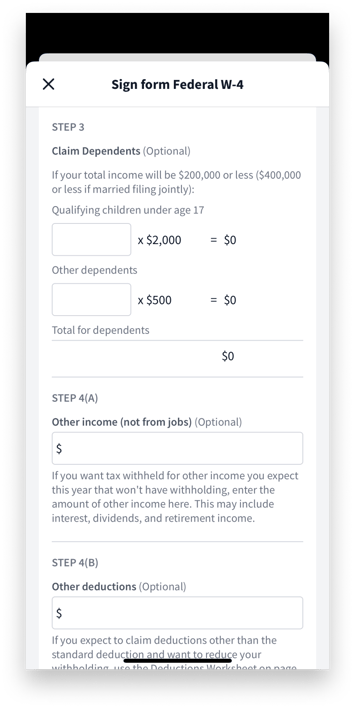

Step 3: Claim your children and other dependents

You want to make sure only one of you allows for child-related tax credits through withholding. Generally, it’s best to allow for child-related tax credits on the Form W-4 of the highest paying job. If you and your spouse each allow for child-related tax credits on your W-4, it will likely result in not enough withholding, and having to pay an additional amount to the IRS at the end of the year.

Step 3 of the W-4 form will ask you how many qualifying children you have under age 17, and how many other dependents you have. After you complete Step 3, your employer will know exactly how much to decrease withholding to allow for your children.

This is also where you can reflect any other tax credits as well if you want the amount withheld from your paycheck. See the Internal Revenue Service (IRS) W-4 Form instructions for details.

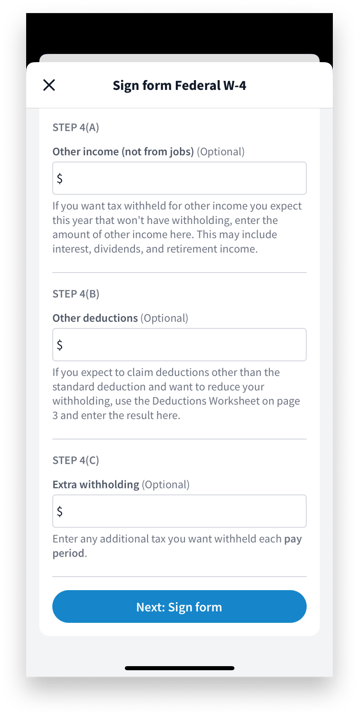

Step 4: Make other adjustments

In Step 4 you can account for other income you receive, deductions you might qualify for and any extra withholding amounts you’d like your employer to take.

- Other income – Amounts added here will increase your withholding

- Deductions – Amounts added here will decrease your withholding

- Extra withholding – Amounts added here will increase your withholding

Just like it’s important for only one spouse to allow for child-related tax credits on their W-4, it’s important that you only allow for other income or deductions on one W-4.

If you expect to itemize deductions instead of claiming the standard deduction, you can also use a deductions worksheet attached to the W-4 form to ask your employer to decrease withholding by a specific amount each pay period.

If you need to claim an exemption from withholding, you can still do that on the new W-4 form. You are exempt from withholding if you owed no federal tax the prior year and you expect to owe no federal tax for the current year. To claim you are exempt, you write “Exempt” on the new W-4 form in the space below Step 4(c).

How to do this in Eddy

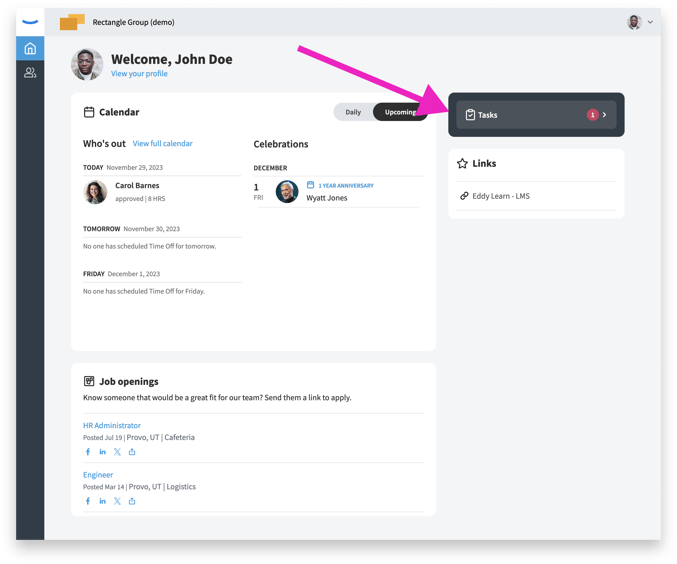

To complete the Form W-4 in Eddy go to your home page and click the Tasks section to open up your tasks.

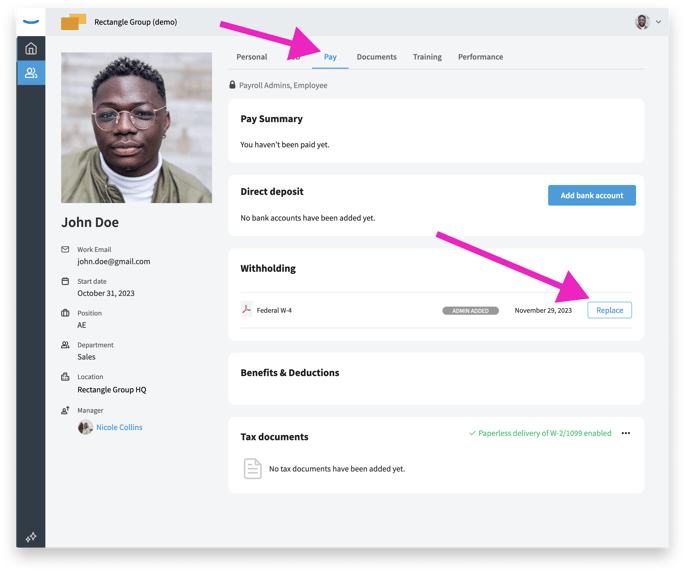

If you don't have an assigned task, this usually means you have already filled our the form W-4 in Eddy or elsewhere. You can update the form at any time by going to the pay tab on your employee profile and clicking the Replace button on the W-4 card.