How to update unemployment rates & frequencies

SUI rates are coming soon

You should be soon receiving the SUI rates from each state you do payroll in.

At times, states may be delayed in sending out rate notices and employers may receive their rates after the January 1 effective date. If we receive the updated rate after the new year, any differences between the old and new rates will be accounted for at the end of Q1. The effective date should still match what is outlined on the rate notice, even if it is in the past.

Some states have a program, called a SUI rate exchange, that will allow Eddy to receive employer SUI tax rates directly from the tax agency. Eddy participates in these programs, where possible, to help ensure your SUI tax liability is calculated based on the correct tax rate. In those cases you may see we have already updated your SUI rates. Note that not all states offer a rate exchange program, so we can't ensure that we will receive all SUI rates. You should always review the tax rates stored in Eddy to ensure accuracy, as it is ultimately your responsibility to provide us with this data.

How to update your SUI rate in Eddy

You should update your SUI rate in Eddy as soon as your receive them from the state.

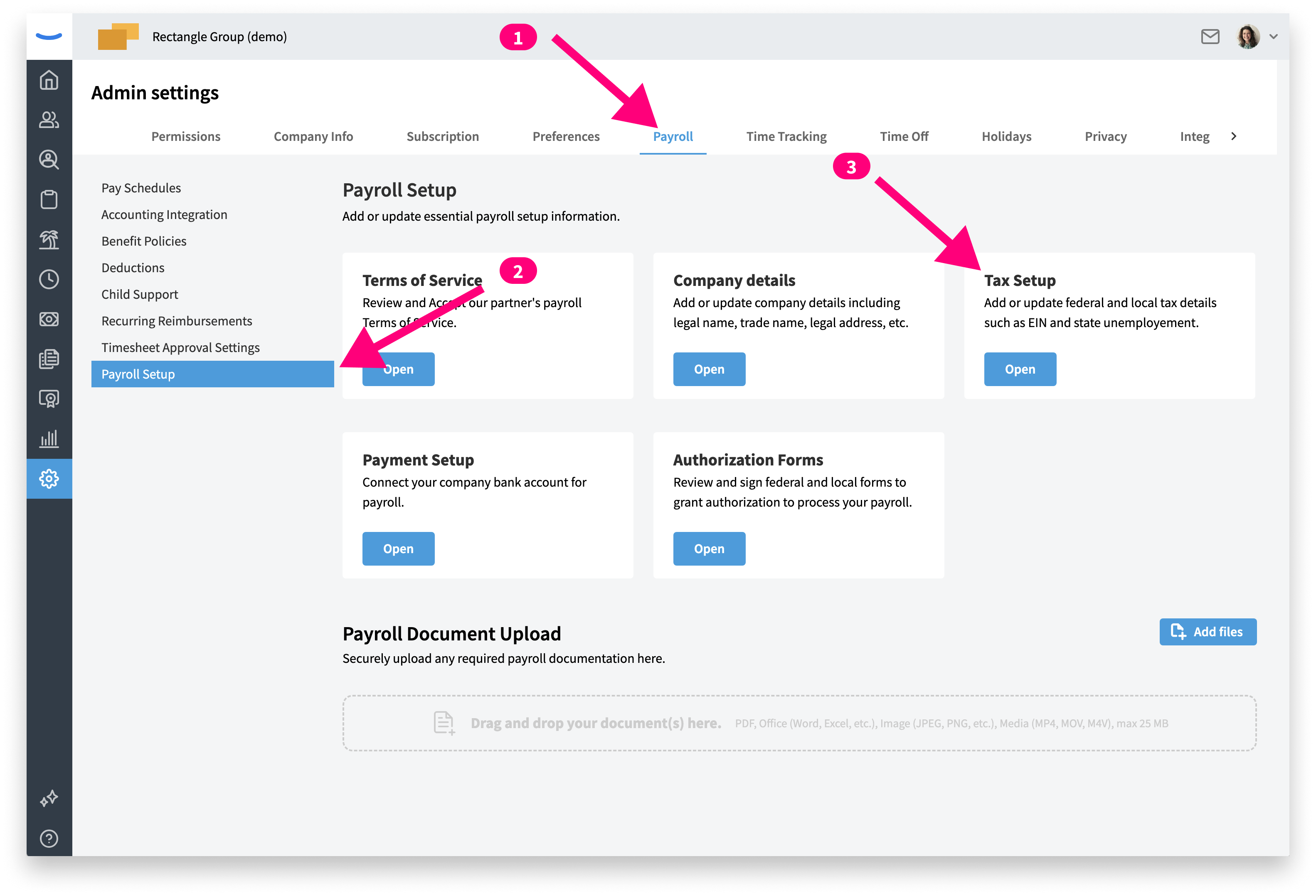

To make the update, log into Eddy with the role of owner or Payroll admin. In the Admin Settings area click the (1) Payroll tab and then find the (2) Payroll Setup page on the left side. From there click open button on the (3) Tax Setup card.

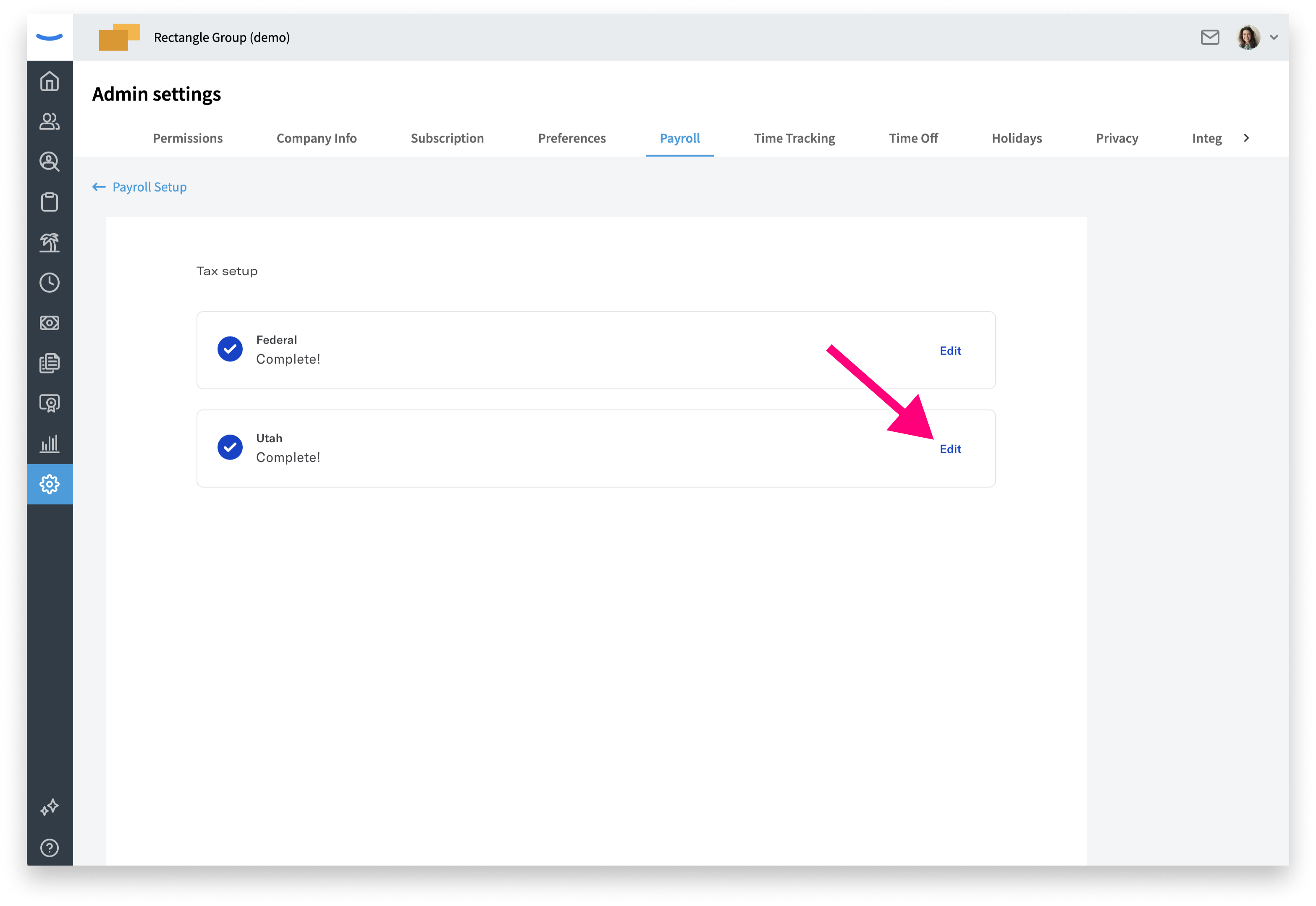

The Tax Setup area is where you'll update the SUI rate for each state. In the example image below we have just one state (Utah). To add a rate, click the Edit button.

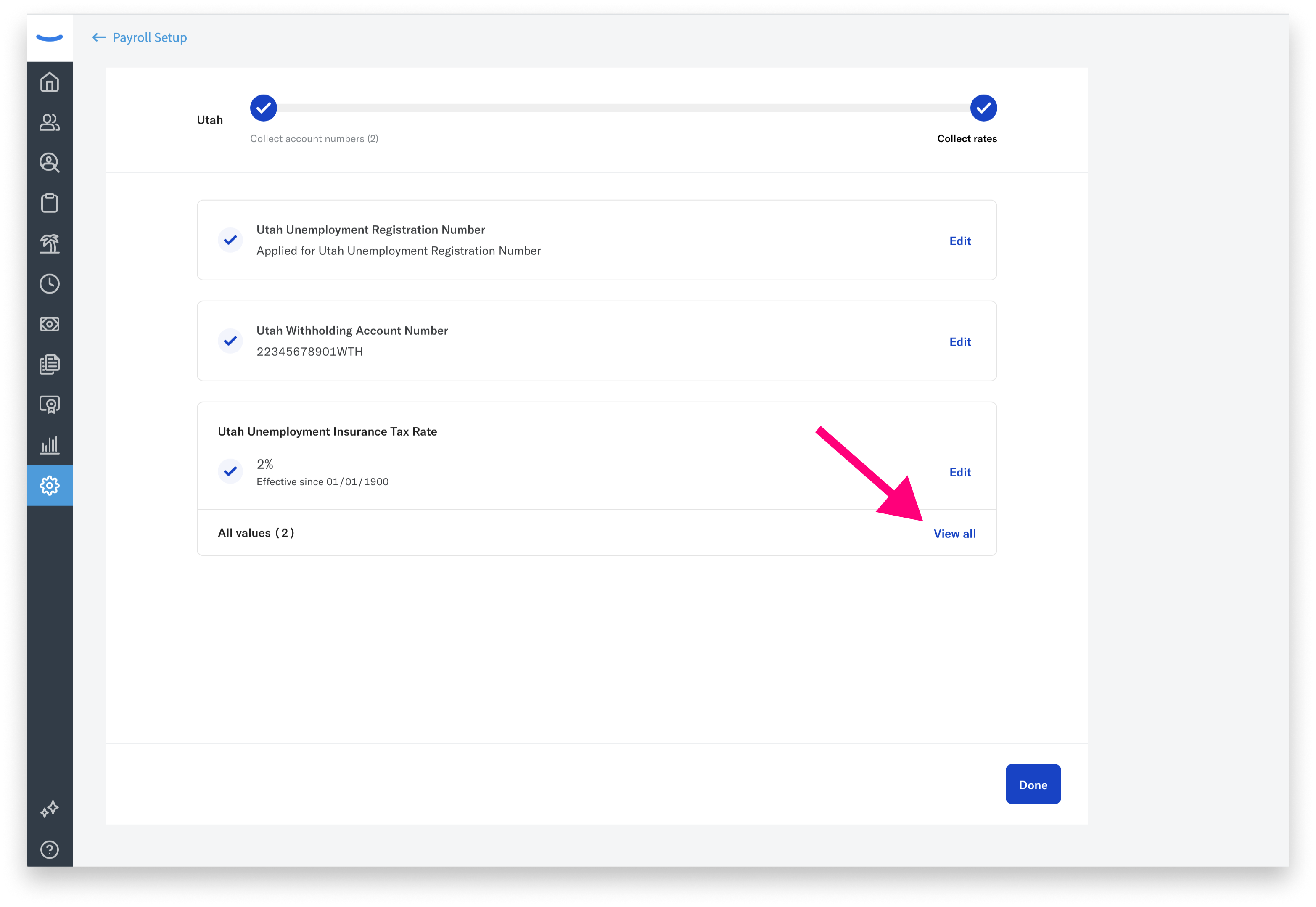

Once the state section is open, find the card for unemployment insurance and click the edit button for that card.

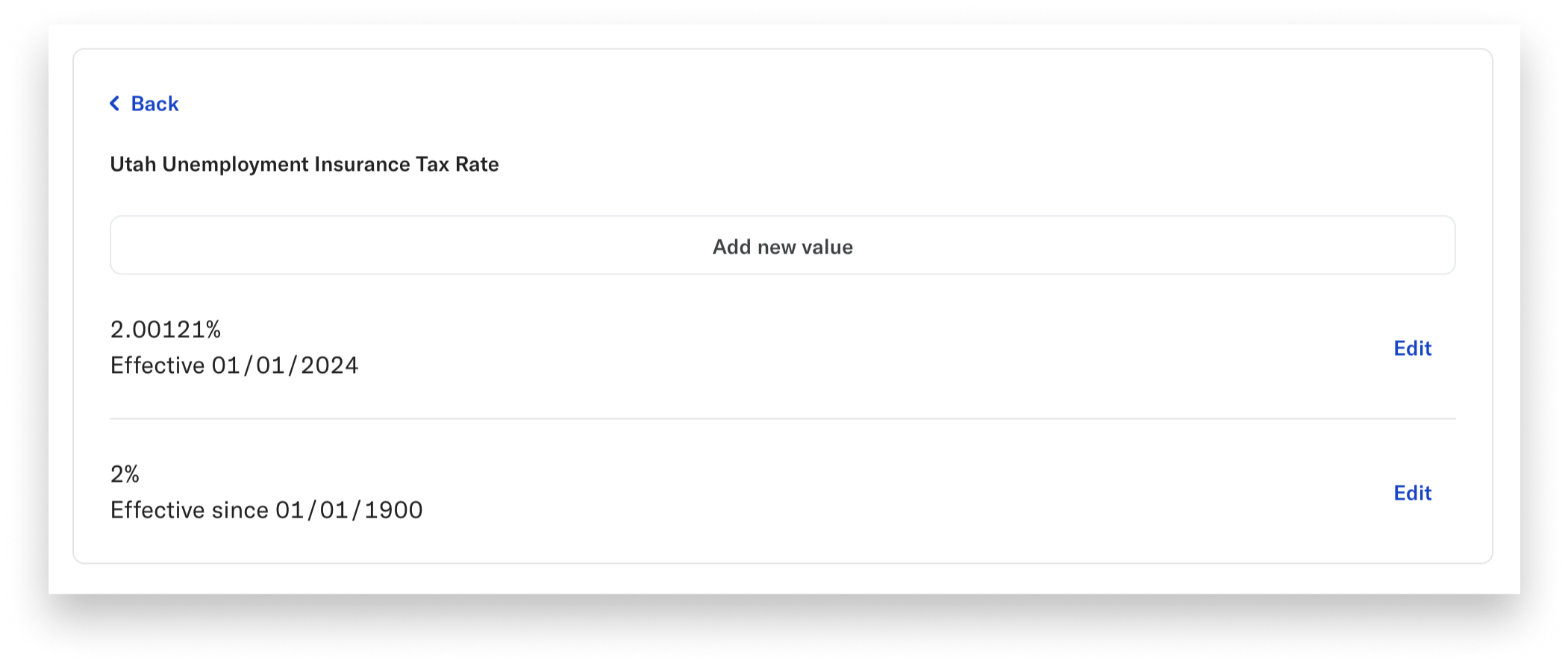

The View all options will show a button to Add new value.

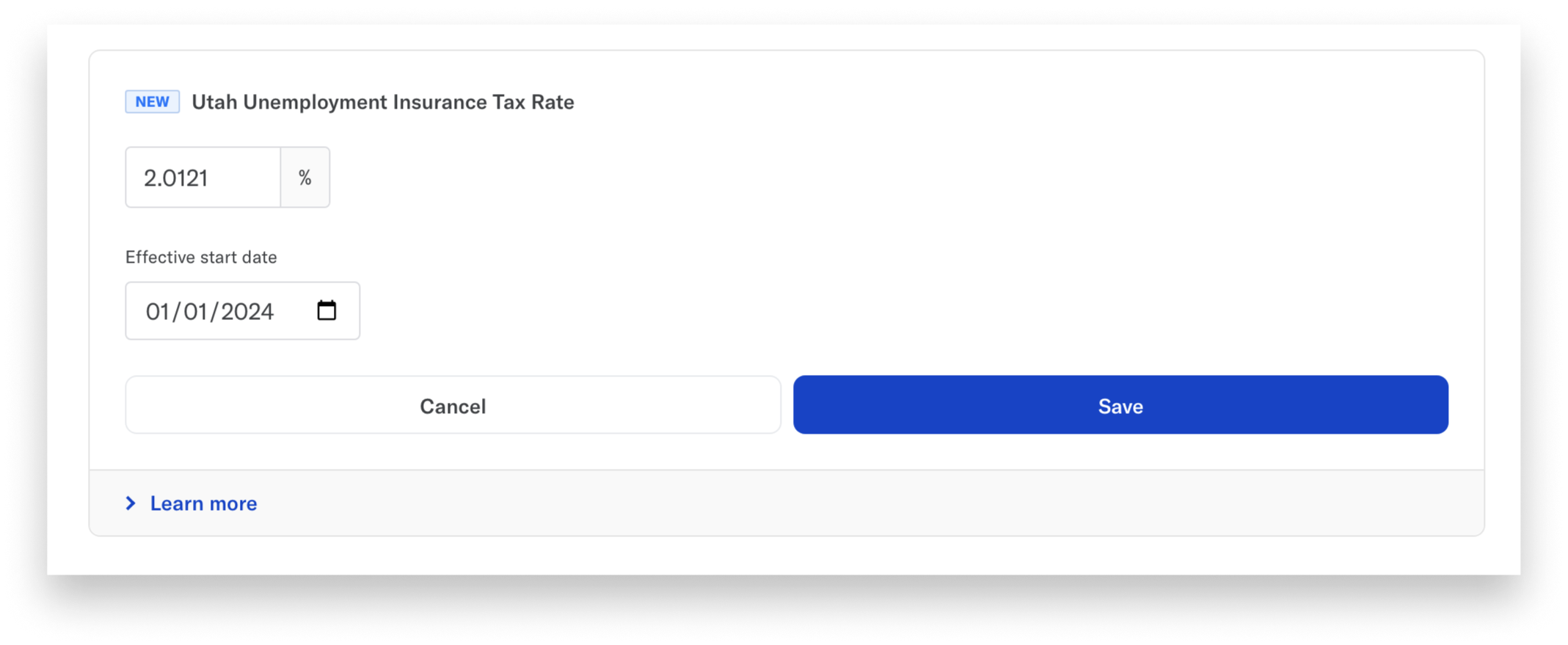

Click the Add new value button to enter the new rate and enter the effective date as outlined on the rate notice.

What is SUI?

State unemployment insurance (SUI) is a employer-funded tax program that gives short-term benefits to workers who have lost their jobs through a layoff or a firing that is not misconduct related.

SUI tax rates are part of the payroll taxes you are responsible for paying as a small business owner. As with many things payroll and taxes, SUI tax rates vary by state. In addition to varying by state, SUI tax rates can also be impacted by factors like how many people have applied for unemployment benefits after leaving your business.