What are the payroll status states in Eddy?

What are the payroll status states in Eddy?

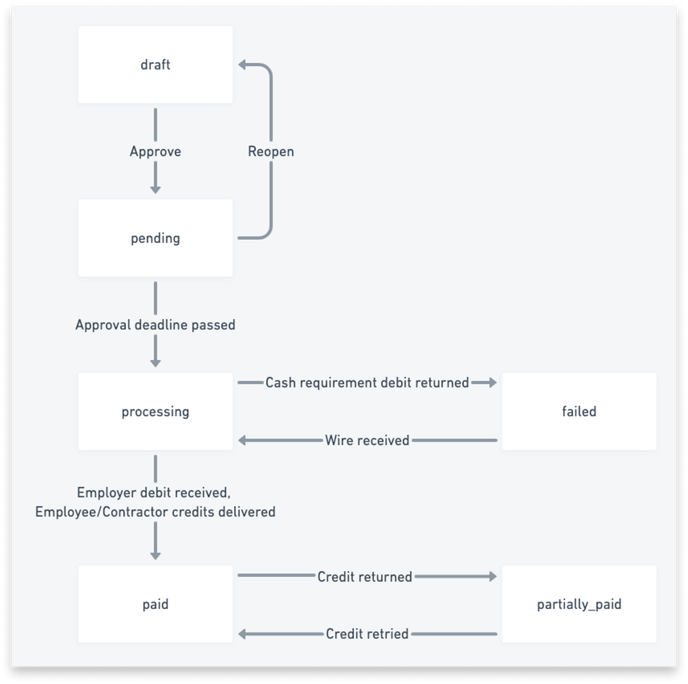

Once a payroll is approved, Eddy will automatically collect funds from the employer's bank account, make sure wages are transferred into employees' bank accounts on payday, and remit tax payments on time. A payroll can have one of four statuses: draft, pending, processing, and paid. Below is an overview of these statuses, what they mean, and how payrolls transition between them.

Draft

When a payroll is first created, it will be in the draft status. You can modify a draft payroll in any way you see fit. Payments to employees can be added and removed, earnings and hours worked can be modified on individual payroll items, etc. You can only delete a payroll while it's in draft.

Note that only draft payrolls can be previewed, and they can be previewed any number of times.

Pending

When a payroll is approved, its status changes to pending. Once pending, the payroll can no longer be modified or previewed. This is because the taxes, net pay, and benefits have been calculated and saved for the payroll.

If you determine that an error exists in the payroll, you can still reopen the payroll, which will move it back into the draft status. Once reopened, a draft payroll can again be modified, previewed, and even deleted. Ultimately, if and when it is approved again, the payroll will move back into the pending status.

Processing

At the end of each business day at 5pm PT, Eddy collects all pending payrolls that have an approval deadline on that day and begins the multi-step process of moving money through the banking system to pay them out. The first step in this process is to submit an ACH transaction to debit the cash requirement for a payroll from the employer’s bank account. When a payroll’s debit transaction has been sent to the ACH network, it moves into a new status: processing.

Once a payroll is processing, it can no longer be reopened. If you require a change to a processing payroll, reach out to us directly.

Paid

Due to the nature of the ACH network, the employer debit transaction will take 3 business days to complete. For example, if you approve a payroll with a Friday payday on Monday, we should have the employer’s funds in our bank account by Thursday morning. Once Eddy has the employer’s cash requirement, we submit ACH transactions to send net pay to each employee who is set up for direct deposit. When these transactions complete, the payroll enters its final status: paid. Once here, the employees' payments for your payroll have been sent out . The employees are happy, and you can can focus on your business!

Partially Paid

Unfortunately, there will be times when an ACH payment to an employee or a contractor is returned. This can happen for a number of reasons, but the most common is an invalid account/routing number or frozen bank account. In cases like these, it is important that you have insight into the exact state of the payments. To handle this, Eddy will mark the payroll as partially paid. This status means that we have attempted to send out employee or contractor payments and one or more of these payments failed. If you need to resolve a failure, please reach out to us directly. After the employee or contractor payment failure has been handled you will see the payroll's status flip back to paid.

Failed

Just as we will unfortunately see times that an employee's payment will fail, there will also be times when the ACH transaction to debit the cash requirement for the employer's payroll will be returned. One common reason this occurs is because there are insufficient funds for the transaction in an employer's bank account at the time of request. When this happens, Eddy sets the payroll's status to be failed and, if possible, pauses in-flight employee and contractor payments for that payroll. Our team then works with you to quickly wire the cash requirement for the failed payroll before unpausing and delivering the payroll's employee and contractor payments.