How to Run Payroll in Eddy

Completing a pay run in Eddy is a simple process. For a high-level overview of the different states a pay run can be in, check out this article that gives an overview of the payroll process.

This article will walk through the 5 steps of Running payroll.

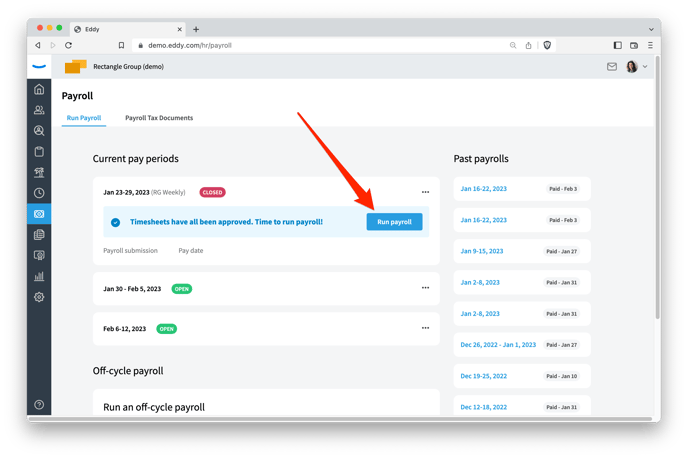

1. Run Payroll Button

Your pay schedule in Eddy regularly creates new pay periods each pay cycle. The pay period has a timesheet that keeps track of all hours worked. The pay period also keeps track of time off approved for each worker.

From the payroll tab, find the pay period that you want to do a pay run for. If the pay period is closed you will find a button to Run payroll. Click that button to get started.

2. Payroll data import

Based on the chosen pay period, Eddy will import known earnings and deductions for each worker. The import will include any approved hours worked, time off info, holiday info, benefits, and post-tax deductions.

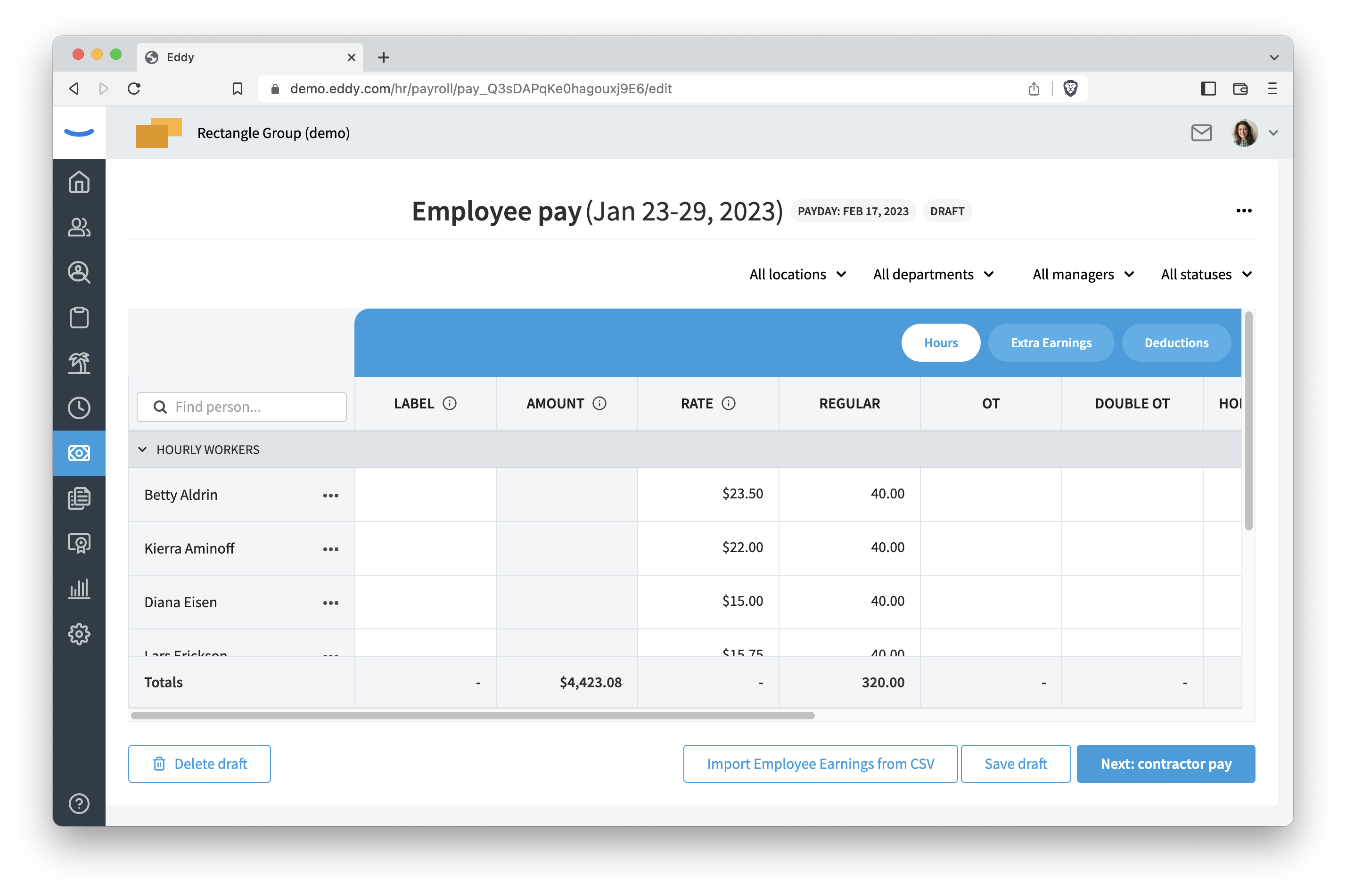

3. Payroll Draft

After the import is complete you'll see a summary of all people connected to the pay schedule. As a payroll admin, you can add or edit information directly on this page. This view is called a payroll draft. The Save draft button will save any changes you make.

Also from this page you can import earnings from a spreadsheet.

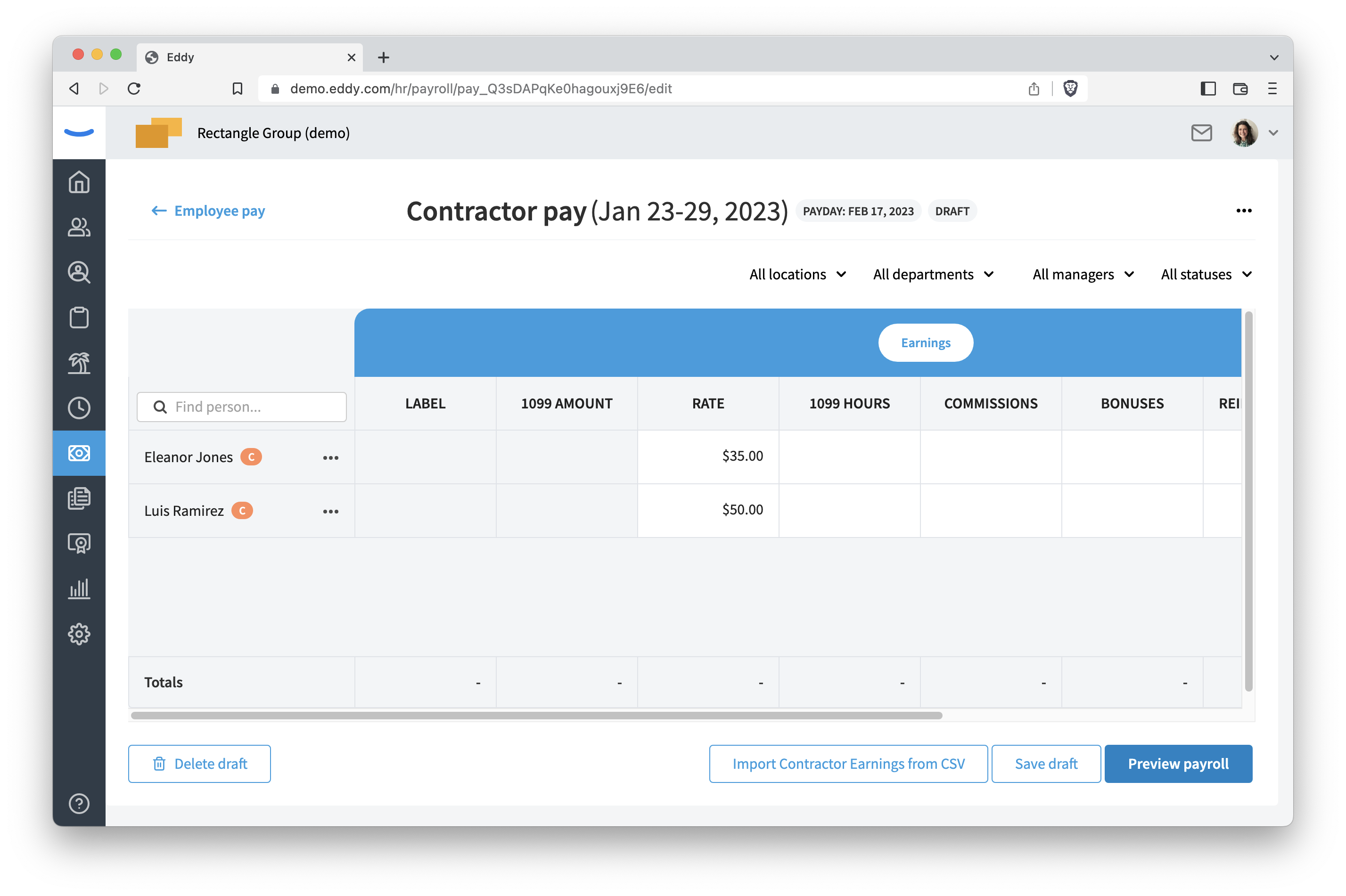

If your company includes contractors, we'll also show a page summarizing all contractor pay

4. Payroll Preview

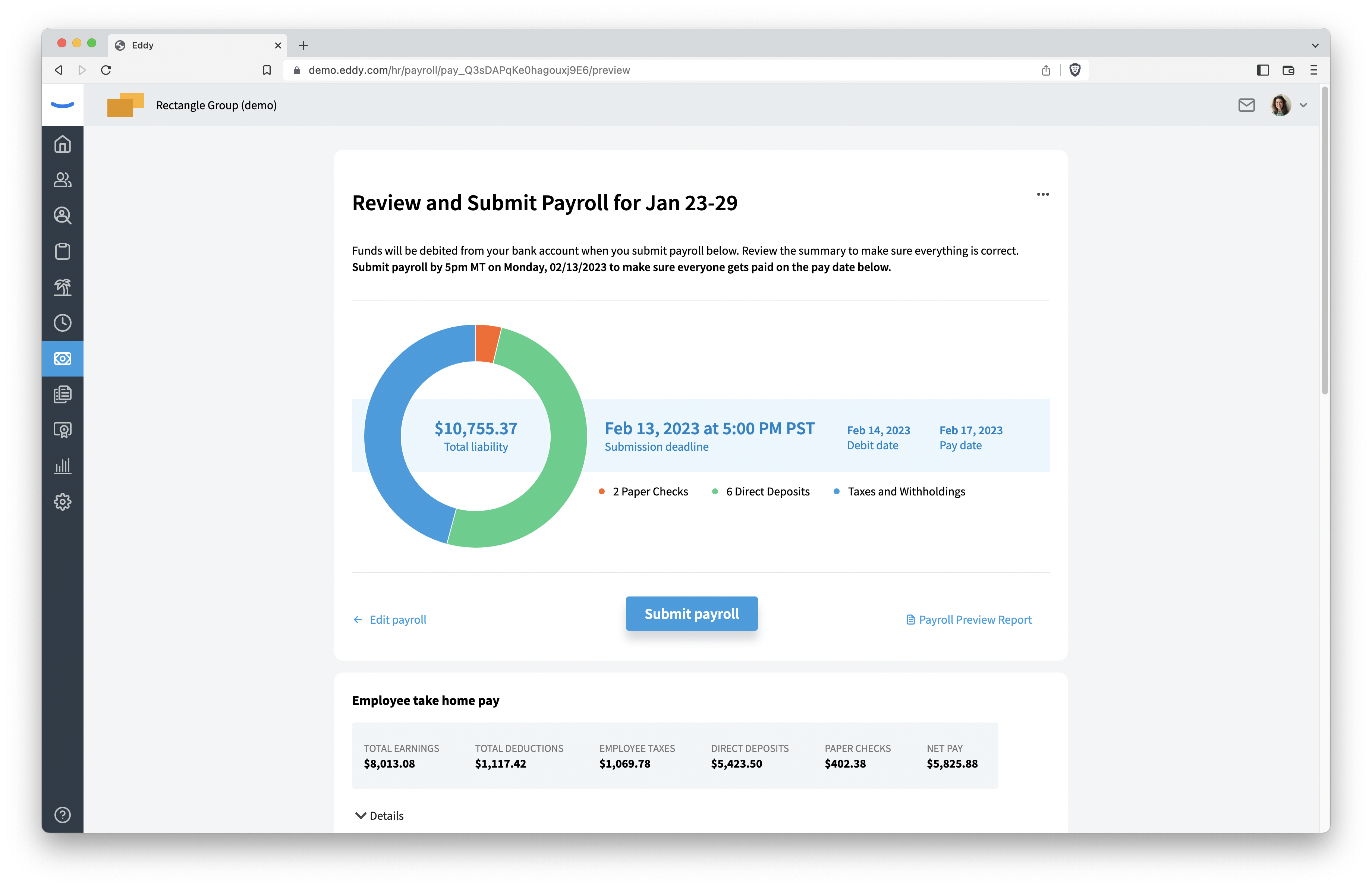

When you have reviewed the payroll draft and are satisfied that all worker earnings and deductions are correct, the next step is to preview the payroll.

This preview step shows the taxes required for the pay run. You'll see the debit amount and the total payroll liability amount. This view also shows how many paper checks (if any) are part of this pay run.

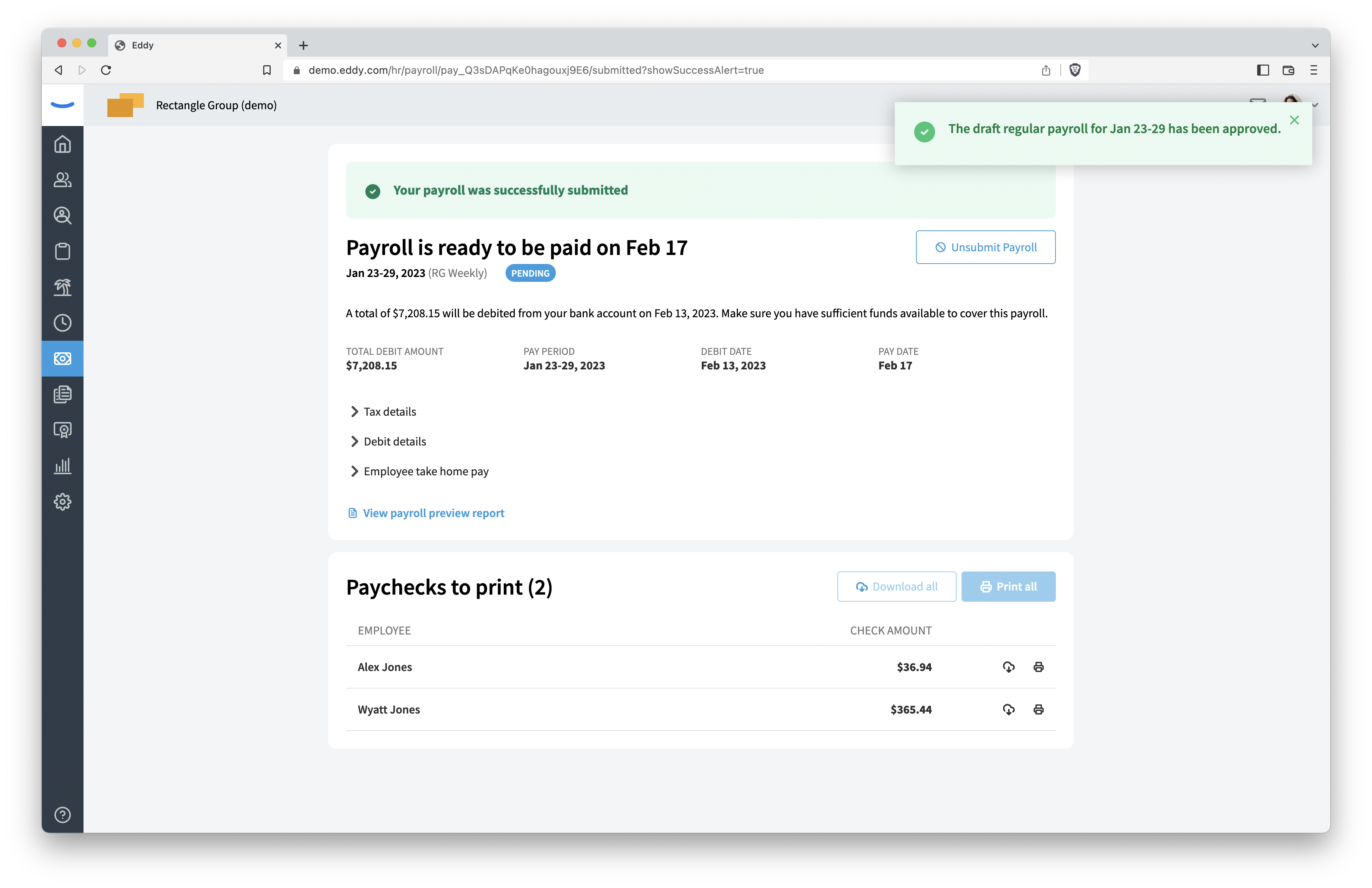

5. Submit Payroll

The next step after Payroll preview is to submit the payroll. This is done by clicking the Submit payroll button. When the pay run is submitted it moves to a Pending state until the submission deadline arrives.